China’s 20th Party Congress

Historic political transition unveils new leadership team under President Xi and charts future route for the country’s domestic development and steepening global ascent

Why the Party Congress Matters

New leaders, constitutional amendments, and national roadmaps

Every five years, China’s senior leaders assemble in Beijing for the most important event on the country’s political calendar, the National Congress of the Communist Party of China (CPC). The closest-watched item on the congress’ agenda is the political transition that occurs within the upper echelons of the Chinese leadership. A new Central Committee, composed of roughly 400 members, is appointed and then officially selects the members of the Politburo and its Standing Committee, the apex of political power in China, immediately following the conclusion of the congress.

But the personnel shake-up is not the only reason why the congress matters. On top of unveiling a new cohort of leaders, the almost week-long conclave also deliberates upon and adopts any revisions to the CPC’s constitution deemed necessary. In addition, it releases a political report which summarizes the CPC’s work and achievements over the past five years and, more importantly, outlines the top-level policy priorities going forward. As such, the document represents the definitive account of the CPC’s viewpoint regarding its priorities for managing China’s domestic development and role on the world stage over the next five years and beyond.

For businesses, the political report provides key signals about China’s future direction on everything from the economy to politics, foreign affairs to the environment. The details of putting the political report’s broad guidelines into action are then developed by government entities such as the National People’s Congress, the State Council, and various ministries in the months following the congress.

20th National congress held amid mounting domestic and global challenges

Taking place at a critical inflection point for China, the 20th National Congress was arguably the most consequential in recent history. A decade ago, President Xi unveiled a vision for the “great rejuvenation” of the country and China has since emerged as a global powerhouse. Now the world’s second-largest economy, it has created a vast consumer class powered by over 400 million middle-income earners, eradicated extreme poverty in rural areas, made major advances in building up its technological capabilities, and dramatically expanded its global influence and footprint, particularly through the Belt and Road Initiative (BRI).

This autumn, however, the congress took place against a challenging backdrop for China, both at home and abroad. Domestically, the country has been contending with a slowing economy, spurred in particular by a property crisis and the impact of strict Covid restrictions. And its external environment has deteriorated significantly, as tensions continue to escalate with the U.S. and Europe and the fallout from the Russia-Ukraine conflict heightens concerns about a global recession.

At the congress, the Chinese leadership defined the headline agenda for addressing these mounting headwinds and also put in place the top leadership team that will be responsible for guiding China’s navigation of them in the coming half decade. In our report, H+K takes a look at how the outcomes from the congress may shape China’s future trajectory and what a new era under a new Xi administration could mean for business.

Summary of key outcomes

A significant restructuring of power in China’s political landscape occurred as President Xi secured a historic third term in office and the new Politburo and its Standing Committee unveiled at the congress were dominated by close associates of the president.

Amid escalating geopolitical tensions abroad and widening socioeconomic inequalities at home, strengthening China’s security and self-reliance, and shifting towards a more inclusive, people-oriented modernization and development strategy under the

renewed “common prosperity” drive were positioned at the heart of the national economic agendagoing forward.

The Chinese leadership vowed to continue advancing the country’s opening up and process of reform, offering further reassurances to the foreign business community

which has grown increasingly concerned about its future prospects in the China market due to the impact of strict Covid-related measures and the hardening divide between China and the West.

Decarbonization was featured in the political report unveiled at a national congress for the first time, further underscoring the party’s strong focus on continuing to accelerate China’s push towards achieving its ambitious 2030/2060 climate goals despite the current slowdown in the Chinese economy.

Continuing to expand China’s role on both the regional and world stages remains a top priority, as the Chinese leadership plans to further deepen the country’s economic and diplomatic influence through international institutions, particularly in the UN system, as well as new and emerging multilateral frameworks like the CDI and the RCEP as well as the more mature BRI.

The leadership reaffirmed its commitment to continue following China’s “dynamic zero-Covid” strategy, signaling that any significant easing of strict Covid-related control measures remains highly unlikely in the near term.

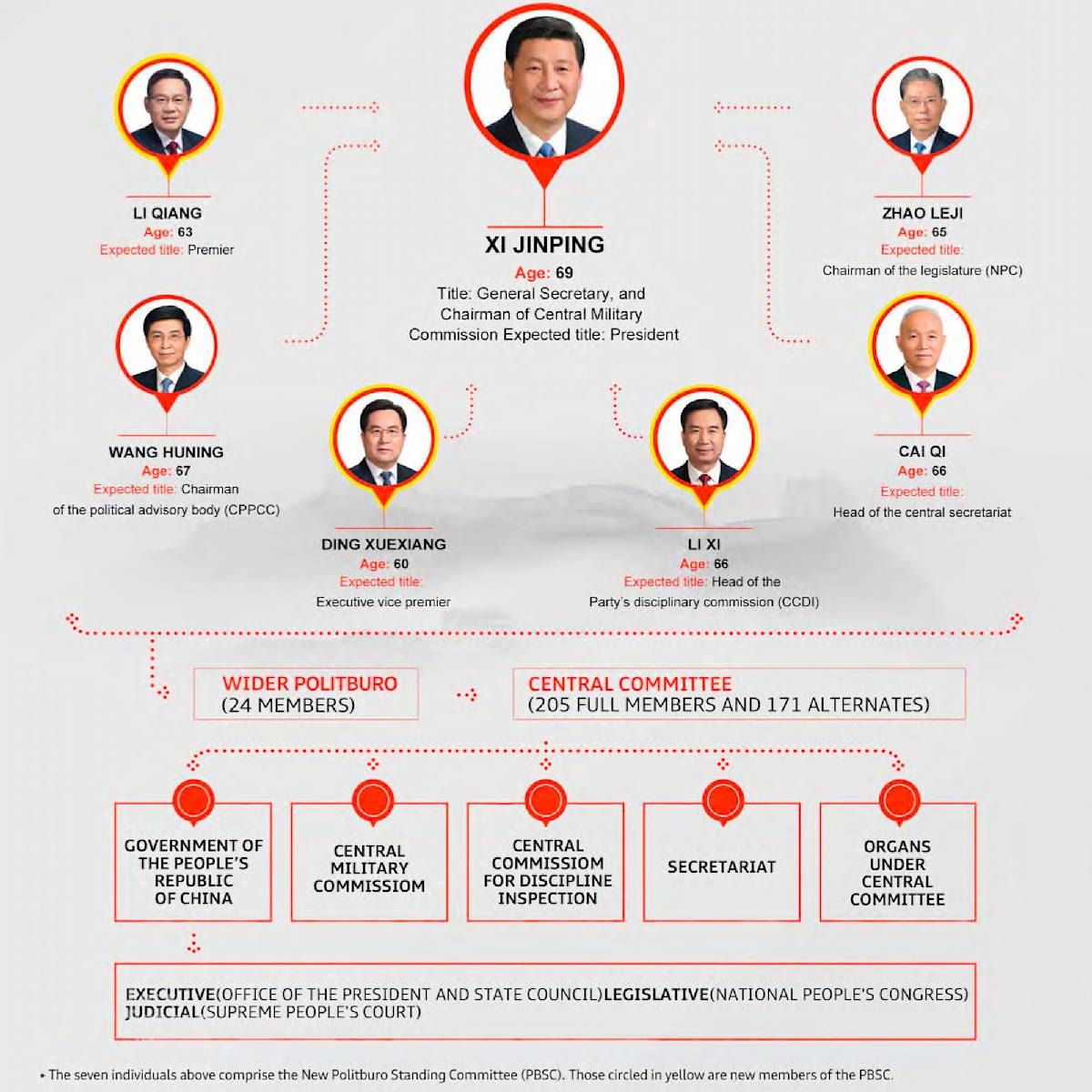

China’s New Leadership 2022-2027

Chinese President Xi Jinping began his unprecedented third term with a major shake-up at the top, retiring veteran Communist Party heavyweights including Li Keqiang and Wang Yang. Xi’s now former anti-corruption head Zhao Leji and ideological chief Wang Huning will remain on the Politburo Standing Committee (PSC) but are likely to be given new portfolios.

The committee’s four new members are all Xi allies and include, in order of rank: Shanghai party boss Li Qiang, Beijing party chief Cai Qi, Ding Xuexiang, head of the General Office of the Central Committee, and Li Xi, the party’s highest ranking official in southern Guangdong province. Li Qiang has been strongly touted to succeed Li Keqiang as premier, although government positions will not be confirmed until China’s parliament convenes its annual session in March 2023.

Leadership Transition: Key Observations

Four departures, four new entrants on China’s top governing body Unexpectedly, Premier Li Keqiang and CPPCC Chair Wang Yang stepped down from the PSC though both were still eligible to remain under the “seven up, eight down” rule for Chinese officials, while Li Zhanshu and Han Zheng are both over 68. The four new inductees are Li Qiang, Cai Qi, Ding Xuexiang and Li Xi.

Absence of a clear successor once again As almost none of the new members are from the generation of 1960s except Ding Xuexiang, including the highly-betted Chen Min’er, President Xi seems well poised to take the driver’s seat for at least the next decade. Yet this could be a tacit way for the president to select and protect his heir given potential tumultuous external and internal challenges.

Promotions dominated by close associates of the president The two holdovers from the previous PSC, Zhao Leji and Wang Huning are both close allies of President Xi while the four new entrants are either early subordinates or advisers. This indicates that the president will be in an even stronger position to push through his political and economic agenda swiftly and efficiently.

Fading profile of figures from the CYLF network Vice Premier Hu Chunhua had been viewed as a strong candidate to join the PSC and replace Li Keqiang as the new premier. This made his exit from even the Politburo all the more surprising. With the retirement of Premier Li, however, it seemed natural for another figure from the Communist Youth League Faction (CYLF) network to be sidelined.

Elevations to the wider Politburo mirror those to the PSC In terms of the turnover in the wider Politburo, more than a dozen new members (14) were appointed, while total membership of the ruling council declined slightly from 25 to 24. Most of the new inductees either had their careers overlap with Xi’s earlier tenures in Fujian, Zhejiang, Shanghai, or the CPC Party School, or other connections to Tsinghua University, the president’s alma mater.

Top economic planner secures promotion He Lifeng, the head of the National Development and Reform Commission (NDRC), China’s lead economic planner, ascended to the Politburo. As another of Xi’s confidants who overlapped with most of the president’s earlier tenure back in Fujian province, his promotion to the Politburo signals that he has a strong chance of being put in charge of overseeing China’s economic development for the next five years.

China’s lead diplomat moves up The ascension of State Councilor and Minister of Foreign Affairs Wang Yi to the Politburo cements the prior elevation of the foreign-policy apparatus’ stature within China’s political system, following former chief diplomat Yang Jiechi’s appointment during the last congress. Wang’s diplomatic performance and efforts in recent years to promote the president’s political thought in foreign policy have clearly been recognized with his entry onto the Politburo. The increasingly assertive brand of Chinese diplomacy seen during his tenure as foreign affairs chief – most noticeable in the nationalistic “wolf warrior” rhetoric – will almost certainly continue in the years ahead.

Business implications

High-quality development: In line with of the national drive to foster high-quality development across the board, central and local governments can be expected to further adjust and fine-tune the focus areas of their regulatory approaches as well as their “KPI” schemes. Companies would be well-advised to keep a close eye on such efforts as they evolve after the congress and pro-actively reconfigure their business plans to ensure continued regulatory compliance while also demonstrating their active support for related initiatives and pilot programs.

Dual circulation: The reaffirmation of China’s “dual circulation” strategy in the political report is likely to see expanded efforts to build a “unified national market” unfold in the coming years, with a particular focus on eliminating regional discrimination and monopolistic activities. This could create new market opportunities which have not yet been available at this stage. Multinationals, especially those in the FMCG sector, should consider stepping up their efforts around actively pursuing new business opportunities as they emerge. The call for “upgrading the quality of international circulation” also means that more importance will be attached to further transforming China’s trade structure and boosting the export of high-value-added products.

Security: The political report highlights China’s intent to build up a retaliatory toolbox against foreign sanctions imposed on China and Chinese businesses. Such efforts can be expected to create more uncertainty for foreign businesses in China as well as Chinese businesses with global ambitions abroad.

Common prosperity: As the political report featured “common prosperity” as an essential requirement for achieving modernization with Chinese characteristics, central agencies and local governments can be expected to rapidly roll out related initiatives and pilots aimed at supporting that endeavor. Multinationals should consider studying existing projects already underway, especially those in Zhejiang Province which has been officially designated as China’s first demonstration zone for the common-prosperity drive. Doing so can help them to better assess how they can effectively leverage their own brands, products and supply chain advantages to support related governmental efforts and establish meaningful partnerships that will help them to raise their corporate profile and support their continued success in the Chinese market.

Green development: The political report further underscored the importance of advancing green development imperatives within China’s economic growth model. For many multinationals, this means that they could enjoy a strong first mover advantage due to their strengths on the sustainability agenda, putting them in a favorable position to share their best practices and actively demonstrate their commitment to support related governmental efforts. They will also potentially be able to benefit from new incentive schemes that central and local governments can be expected to roll out in support of the country’s accelerating sustainability drive. Reorienting China’s growth paradigm around greener, more people-centric development will also mean that sustainability will almost certainly receive spiraling levels of attention from Chinese authorities and government media throughout the next few year.

Tech priorities: Ensuring the stability of tech supply chains was highlighted as a matter of national security at the congress, as concerns continue to grow in Beijing over escalating Sino-U.S. tensions. Efforts to resolve bottlenecks on critical technologies and foster urgently needed talent by improving the national education system will likely translate into increased investment in the Research & Development of advanced technology, the strengthening of intellectual property protection, and the continued promotion of the digital economy.

China Inc: Outside of China, skepticism about the benefits of Chinese investment, discontent over the lack of reciprocity in terms of market access, and ongoing political headwinds can be expected to continue to impact the global ambitions of China Inc. It will be critical for Chinese companies to direct greater efforts towards making their decision-making more transparent – for example, in particular with regard to their strategic intentions and corporate structures – and emphasize the win-win nature of their investment overtures and the considerable benefits yielded to host countries.

Zero-Covid policy: With the congress having further underscored the Chinese leadership’s commitment to continue following its zero-Covid policy, it now appears increasingly unlikely that businesses will see any notable relaxation of strict Covid-related control measures before the end of the year or before the Two Sessions next March. The late spring or second half of 2023 may be the earliest point at which companies could start to see a gradual easing of China’s zero-Covid strategy.

If you are interested in obtaining the full analysis report – get in touch with our Government & Public Affairs team in China: GPABeijing@hkstrategies.com